How I Stopped Gambling on Stocks and Built a Smarter Portfolio

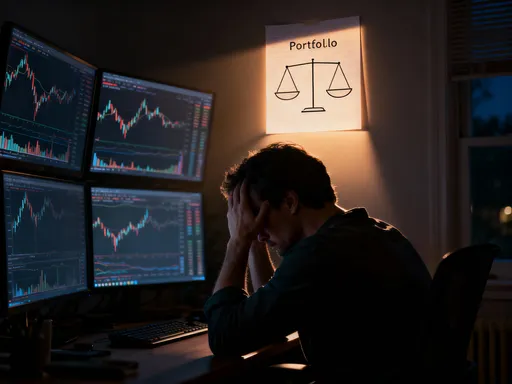

I used to think investing meant picking winners—tech today, crypto tomorrow, chasing every hot tip. Then I got burned. Hard. That wake-up call forced me to rethink everything. Instead of returns, I started focusing on survival, stability, and strategy. What changed? A real shift toward risk-aware asset allocation. This isn’t about getting rich quick—it’s about staying rich, staying safe, and building wealth that lasts. Let me walk you through how I rebuilt my financial life, one balanced decision at a time.

The Wake-Up Call: When My Portfolio Crashed

It started with confidence—too much of it. I had read a few articles, watched some finance videos, and believed I could outsmart the market. My portfolio became a playground of speculation: a heavy bet on a single tech stock, a risky cryptocurrency, and an emerging market ETF that promised explosive growth. For a while, it worked. The numbers climbed, and I felt brilliant. But that brilliance was short-lived. When the market turned, my portfolio collapsed faster than I could react. I lost nearly 40% of my savings in less than six months. It wasn’t just the money—it was the sleepless nights, the anxiety every time I opened my investment app, the guilt of knowing I had put my family’s financial security at risk.

That experience was a brutal lesson in the difference between investing and gambling. I had confused volatility with opportunity, and momentum with strategy. What I thought was bold decision-making was actually recklessness dressed up as confidence. The hardest part wasn’t the financial loss—it was the realization that I had no real plan. I had no rules, no framework, no way to measure whether I was taking on too much risk. I was reacting to headlines, not managing my future. That moment of clarity changed everything. I stopped trying to win the market and started asking how I could protect what I had while still growing it responsibly.

The emotional toll was just as significant as the financial one. As a parent and a partner, I had always seen myself as someone who made thoughtful choices. But this experience exposed a blind spot: my approach to money. I had treated my investments like a side project, something to tinker with in my free time. But the truth is, your portfolio isn’t a game. It’s the foundation of your long-term security, your children’s education, your retirement dreams. When I finally accepted that, I knew I had to change. Not just my investments, but my entire mindset.

Rethinking Risk: From Fear to Strategy

For years, I saw risk as something to avoid entirely. I thought the goal was to find the perfect investment that would go up without ever going down. But that’s not how markets work. Risk isn’t the enemy—it’s a constant, like gravity. The real skill isn’t avoiding risk, but understanding and managing it. Once I shifted my thinking from “How can I make the most money?” to “How much can I afford to lose?”, everything changed. I began to see risk not as a threat, but as a variable I could measure, balance, and control.

There are different kinds of risk, and each requires a different response. Market risk is the chance that stock prices will fall. Inflation risk is the danger that your money won’t grow fast enough to keep up with rising prices. Personal risk includes job loss, health issues, or unexpected expenses. Ignoring any of these can undermine even the most promising portfolio. I learned that protecting capital is just as important as growing it. A 20% loss requires a 25% gain just to break even. That math hit me hard. If I lost half my portfolio, I’d need a 100% return just to get back to where I started. That’s not a game I wanted to play.

So I started building a strategy around risk management. I asked myself honest questions: What would happen if the market dropped 30% tomorrow? Could I still pay my bills? Would I panic and sell at the worst time? I realized I needed a portfolio that could withstand downturns without forcing me to make emotional decisions. That meant accepting lower potential returns in exchange for greater stability. It wasn’t exciting, but it was sustainable. I began to see steady progress as more valuable than dramatic swings. The goal wasn’t to get rich overnight—it was to avoid getting wiped out.

The Core Idea: What Asset Allocation Really Means

Asset allocation is the backbone of smart investing. At its core, it means spreading your money across different types of investments—stocks, bonds, real estate, cash—so that no single loss can destroy your portfolio. It’s not about picking the next big winner. It’s about creating a mix that balances growth and protection based on your goals, timeline, and comfort with risk. Think of it like a balanced diet: you wouldn’t eat only sugar, no matter how good it tastes. In the same way, you shouldn’t invest only in high-risk assets, no matter how high the potential returns.

What makes asset allocation powerful is that different asset classes don’t move in lockstep. When stocks fall, bonds often hold steady or even rise. Real estate might perform well when inflation is high. Cash gives you flexibility when opportunities appear. This lack of perfect correlation is what reduces overall risk. Even if one part of your portfolio struggles, others may compensate. Over time, this smoothing effect leads to more consistent results. Studies have shown that asset allocation explains the majority of a portfolio’s long-term performance—far more than stock-picking or market timing.

Your personal circumstances shape your ideal mix. A young professional with decades until retirement can afford to take on more stock market risk because they have time to recover from downturns. Someone nearing retirement may need more bonds and cash to protect their savings. Your job stability, income needs, and financial goals all play a role. The key is to build a plan that reflects reality, not fantasy. A well-allocated portfolio won’t make you the richest person at the party, but it will help you sleep at night and stay on track for your long-term goals.

Building the Foundation: Stocks, Bonds, and Beyond

A mature portfolio rests on several pillars. Stocks offer growth over time through company earnings and dividends. Historically, equities have delivered higher returns than other asset classes, but with more volatility. That’s why they’re best suited for long-term goals. Bonds, on the other hand, provide income and stability. When you buy a bond, you’re lending money to a government or company in exchange for regular interest payments. They tend to be less volatile than stocks and can act as a buffer during market downturns.

Beyond stocks and bonds, there are real assets like real estate and commodities. These can serve as hedges against inflation. For example, when prices rise, property values and rents often increase too. Cash and cash equivalents—like savings accounts or short-term Treasury bills—offer safety and liquidity. They don’t grow much, but they’re there when you need them. Together, these categories form a diversified foundation that reduces reliance on any single market or sector.

Global diversification is another critical piece. It’s natural to favor investments in your home country—this is called home bias—but it can be risky. If your entire portfolio is tied to one economy, you’re exposed to that country’s unique challenges. By investing in international markets, you spread that risk. Emerging markets may offer growth potential, while developed markets provide stability. A globally diversified portfolio doesn’t guarantee profits, but it reduces the chance of catastrophic loss from a single region’s downturn.

The key is to avoid chasing trends. Just because a certain sector is hot today doesn’t mean it belongs in your portfolio. Broad market exposure—through low-cost index funds or ETFs—gives you access to thousands of companies without betting on any one of them. This passive, disciplined approach has helped millions of investors build wealth over time without the stress of constant decision-making.

Adjusting for Life: How Age and Goals Shape Strategy

Your asset allocation shouldn’t stay the same for decades. It should evolve as your life changes. In your 20s and 30s, you likely have a long time horizon. That means you can afford to take on more risk in pursuit of growth. A portfolio weighted heavily toward stocks makes sense during these years because you have time to recover from market drops. As you move into your 40s and 50s, the focus gradually shifts. You’ve accumulated more wealth, and protecting it becomes more important. This is when many investors begin to increase their bond and cash allocations.

By the time retirement approaches, capital preservation often becomes the top priority. You don’t want to risk a major loss just as you’re about to rely on your savings for income. A common rule of thumb is to subtract your age from 100 or 110 to determine your stock allocation. For example, a 60-year-old might aim for 40% to 50% in stocks, with the rest in bonds and cash. While not perfect, this guideline helps prevent overexposure to risk at a vulnerable stage of life.

Different goals also require different strategies. Saving for a child’s college in 10 years calls for a more conservative mix than saving for retirement 30 years away. A down payment on a house in five years should be kept in safer, more liquid investments. The one-size-fits-all approach fails because life isn’t one-size-fits-all. Regular check-ins—once a year or after major life events—help ensure your portfolio stays aligned with your needs.

Rebalancing is a simple but powerful tool. Over time, some investments grow faster than others, shifting your original mix. If stocks surge, they might become 80% of your portfolio instead of 60%. Rebalancing means selling some of the winners and buying more of the underperformers to return to your target allocation. It forces you to buy low and sell high, which is the opposite of emotional investing. It’s not exciting, but it’s effective.

Hidden Traps: What Most Investors Overlook

Even with a solid plan, investors often fall into avoidable traps. One of the most common is overconfidence. After a few good years, it’s easy to believe you’ve mastered the market. But markets are unpredictable, and past performance is no guarantee of future results. Frequent trading is another pitfall. Every time you buy or sell, you incur costs—commissions, spreads, taxes. These expenses eat into your returns, especially over time. Studies show that the average active investor underperforms the market after fees.

Fees are a silent wealth killer. A 1% annual fee may seem small, but over 30 years, it can reduce your final balance by nearly a third. That’s why low-cost index funds and ETFs are so powerful—they deliver broad market exposure for a fraction of the cost. Tax efficiency matters too. Selling investments in a taxable account can trigger capital gains taxes, which reduce your net returns. Holding investments longer or using tax-advantaged accounts like IRAs or 401(k)s can help minimize this drag.

Behavioral biases are perhaps the hardest to overcome. We’re wired to fear losses more than we value gains, which leads to selling in a panic and buying in a frenzy. We chase performance, jumping into hot sectors after they’ve already risen. We ignore data and follow the crowd. These tendencies sabotage even well-designed strategies. The best defense is a written investment plan that outlines your goals, risk tolerance, and asset allocation. When emotions run high, the plan acts as a anchor.

Simplicity is often underrated. You don’t need exotic investments or complex strategies to build wealth. A simple, diversified portfolio of low-cost funds, held consistently over time, has made most investors rich—not overnight, but steadily. Complexity creates confusion, and confusion leads to mistakes. The goal isn’t to impress others with your strategy, but to create a plan you can stick with for decades.

Staying the Course: Discipline Over Drama

The final lesson I learned is that consistency beats timing. No one can predict the market with any reliability. The most successful investors aren’t those who pick the best stocks or avoid every downturn. They’re the ones who stay invested through ups and downs, guided by a clear plan. Market volatility is inevitable. What matters is how you respond to it. Reacting emotionally—selling after a drop, buying after a surge—guarantees poor results. Sticking to your allocation, rebalancing when needed, and ignoring the noise leads to better outcomes.

Regular, low-pressure check-ins are essential. Reviewing your portfolio once a year helps you stay on track without overreacting to short-term swings. Life changes—marriage, children, job shifts, retirement—require adjustments, but these should be thoughtful, not impulsive. A disciplined routine reduces stress and increases confidence. You stop worrying about every headline and start focusing on what you can control: your savings rate, your asset mix, your spending habits.

Building a resilient financial future isn’t about luck or genius. It’s about thoughtful, risk-aware decisions made consistently over time. It’s about designing a portfolio that reflects who you are and where you’re going, not what’s trendy. It’s about knowing that true wealth isn’t measured by the highest peak, but by the ability to keep moving forward, no matter what the market does.

Today, my portfolio isn’t the most exciting. It doesn’t make headlines. But it’s stable, diversified, and aligned with my life. I no longer chase returns. I focus on sustainability. And for the first time, I feel in control. That peace of mind is worth more than any short-term gain. If you’ve ever felt overwhelmed by investing, remember: you don’t have to be brilliant. You just have to be consistent, patient, and disciplined. That’s how real wealth is built—not in a moment, but over a lifetime.